|

Who Benefits from SRECs?

Solar Renewable Energy Credits (SRECs) are popular with politicians of several states but much less popular with solar developers and solar owners – due to their uncertain value. So who actually benefits from them?

The idea for an SREC-only market was born in New Jersey in 2004-2005, when the state started running out of money for rebates. Due to continued problems funding the popular program, the state phased out rebates for all but a limited number of residential projects. During the transition, the state looked at both Feed in Tariffs and SRECs, but eventually decided that SRECs were a more suitable way to create a market. No surprise there – they don't cost the state anything and give the impression of promoting solar energy … but do they work as well as Feed in Tariffs?Let's take a look.

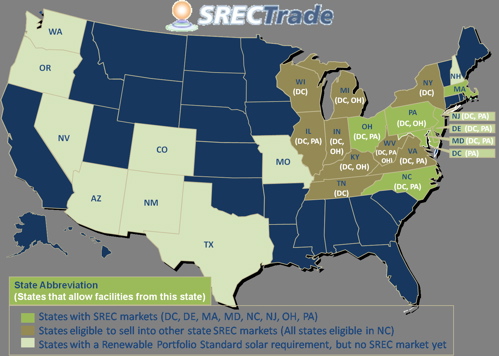

The "blue" states do not have SREC programs – but the rest of the states do so obviously the idea has spread from New Jersey – especially through the Midwest.

In states like Delaware, Massachusetts, Maryland, New Jersey, Ohio and Pennsylvania, energy suppliers are required to accumulate a certain number of SRECs to meet a mandated generation target. Power providers can generate the credits themselves by investing directly in projects, or purchase the credits from project owners, brokers or aggregators. Many states will certify solar electric systems from out-of-state and allow the SRECs from those facilities to count towards the RPS. The map above shows what state individuals can sell their SRECs into.

In SREC states, the Renewable Portfolio Standard (RPS) requires electricity suppliers to secure a portion of their electricity from solar generators. The SREC program provides a means for Solar Renewable Energy Certificates (SRECs) to be created for every megawatt-hour of solar electricity created. Once the installation of a solar system is complete, the system must then be certified by the state(s) in which it is eligible to sell SRECs and then must create an account with the tracking platform used by that state. Once registered, every month, the tracking platform will issue SRECs based on the generation of your system. In some states, estimated generation is used for systems under 10kW, while all other systems are required to submit generation on a monthly basis. 1 SREC = 1,000 kWh of solar electricity = 1 MWh of solar electricity produced 10 kWp solar capacity = approximately 12 SRECs per year. The SREC is sold separately from the electricity and represents the "solar" aspect of the electricity that was produced.

There is no assigned value to an SREC. Prices are influenced by supply and demand. The supply is determined by the number of solar installations producing SRECs and trading them. The demand is determined by individual state RPS solar requirements and the Solar Alternative Compliance Penalty (SACP) set by the state. The RPS solar requirement represents the number of SRECs the electric suppliers are required to collect each year. The SACP is the penalty amount per SREC paid by the electric suppliers if they do not collect enough SRECs. In general the price that SRECs trade at is typically less than the SACP charged by the states if the electric company does not reach it's quota. For example - in New Jersey, where the SACP in 2010 is $693 SRECs are trading at around $570 … or approximately 82% of the SACP rate. Since the SACP rates can vary by state and even over time … the future value of the SRECs is difficult to estimate … and therefore the long term benefit for the developer / solar project owner makes it difficult for them to forecast their net revenues and therefore obtain long-term financing.

In theory - the sale of SRECs is intended to promote the growth of distributed solar by shortening the time it takes to earn a return on the investment. This is more easily accomplished if the SRECs can be sold on a long-term basis, which larger projects require in order to obtain project financing or solar energy investors require to produce predictable yields … but much less so when sold into a fluctuating spot market (the typical situation for residential and small commercial rooftop projects). However, in practice while it is generally possible to fairly accurately predict the amount of electricity a specific solar installation will produce over time the variability of SRECs in a free-market economy – especially factoring the likelihood that SECP rates will change from year to year for political and market reasons – estimating the potential economic values of SRECs over the life of a project and newness of this incentive program and instability in the pricing make it difficult to obtain the long term financing needed by most developers to build mid-sized to larger solar energy projects.

Yes there is … and its growing, but the market is dividing into two tiers: Tier 1: Large project developers, who may be generating thousands of SRECs each year, are able to negotiate contracts directly with energy suppliers, securing far more favorable terms and pricing than smaller players. Some are worried that this could limit diversity in the market.

Since it is very costly for electric suppliers to buy direct from individuals, solar owners have limited options for selling their SRECs. Most suppliers will either issue cumbersome requests for proposals (RFPs) or work directly with third-party aggregators and brokers – such as the three listed in the previous section. Prior to these brokerage services, individual solar generators had little visibility into actual SREC market prices as well as markups charged by middlemen. In many cases, an SREC is traded several times before reaching the electric supplier. Even with the emergence of aggregators / brokerage services it will typically take a few months before you begin receiving payments. For example, if your system goes online on January 1st, your January generation will be recorded on February 1st. Your first SREC(s) will be actually credited to your account on March 1st. They would then be sold in the March auction, so your first payment would come in late March. After that, payments will come as SRECs are generated. Also note: some states operate on a quarterly basis, rather than monthly.

The primary buyers of SRECs are utility companies – who are looking to avoid paying the legislated SEPC penalties. There are some private buyers too – but they appear to be in the minority. As always – the utility companies pass along the cost the SRECs to their customers … in much the same way that the costs for Feed in Tariffs are passed back to the customers.

While more than 63 countries and several states and provinces have implemented Feed in Tariff systems - they have yet to make major headway in America. This is ironic, since the original Feed in Tariff system was developed in the USA – although it took the Germans to really make it work well – so well in fact that with much less sun than in most of the USA – they lead the world in the installation of solar energy systems. Speaking as a developer of solar energy projects – the appeal of a Feed in Tariff System is simple. Under the Feed in Tariff system you know before you build your system and connect it to the grid exactly how much you will be receiving for each kWh of electricity produced – for the next 20 years. This stability in income means that homeowners, investors and bankers can trust in the projections and provide the money to build new systems. The appeal of the Feed in Tariff systems in the EU makes sense – because they have a lack of fossil fuels and a ground swelling of support for renewable energy solutions to make them energy independent. However, according to studies in the USA more than 90% of people surveyed favor solar energy. So why are SREC programs so popular? Is it because the states don't have to pay? Is it because it favors big utility companies (who spend a lot of money on political lobbying? The two policies are often compared side-by-side because they represent different ends of the philosophical (and perhaps ideological) spectrum over how best to incentivize solar. Because these programs are still so new, their effectiveness over the long term is unclear. Some installers – many of whom are advocates of FITs – believe SREC programs create too much volatility and favor larger commercial and industrial-scale project developers. All the major emerging SREC markets are in deregulated states. Under deregulation, energy suppliers are short-term players in the market. Thus, they have been unwilling to sign contracts for longer than five years in states like New Jersey and Maryland. (In Maryland's case, there is a requirement that SREC generators bid for 15-year contracts, but energy suppliers have been more willing to pay the penalty than enter into such long agreements). Thus, a number of installers have found it difficult to finance projects with a 30-year lifetime based upon contracts for five years or less. New Jersey is the only state with enough experience to gauge success of SRECs. After a couple years of missing solar targets during the program transition, the industry is finally catching up – driven by the high prices of SRECs due to limited supply. The average market price for an SREC has been about $570, or $0.57 per kilowatt-hour. That's well above the cost of generating solar electricity. The high SREC prices have driven a flurry of new development in the state. However, if the industry overshoots its targets for 2011 and there's an oversupply of SRECs in the market, prices could drop substantially and hurt the financial viability of projects. Some are worried that it could put some installers out of business. A number of fixes to these issues have been proposed: Some want to see required long-term contracts to provide security; some are hoping to create a hybrid structure where FITs target the smaller end of the market and SRECs are used for large projects; and a few people are even proposing that states with SREC markets start from scratch and implement pure-play FITs. (The likelihood of that is very slim). While SRECs are certainly gaining traction and will likely be an important part of American solar policy, it may be another year or two before we know how effective they are. Depending on how these emerging markets perform, there may be a lot more experimentation ahead. So which program is best? I think it's pretty easy to determine in a "free economy" – just look at how many GW of solar projects are being installed in countries with FIT programs … and how many are being installed in areas that offer SRECs … FIT wins by a large margin.

Also – look at who is installing solar. In Germany and Italy – two of biggest proponents of the FIT program – the majority of the installations are being made on homeowners roofs – families are benefiting. Speaking from first hand experience – we have a waiting list of major investment funds looking to buy solar projects in Italy – because of the FIT program and the rates of return currently available. In the USA – the fastest growth is happening in utility sized and sponsored projects – where the utilities are benefiting. I predict that in the next few years – continued technological improvements and economies of scale will bring the cost of solar systems down so that they won't depend on the state incentive programs – people will be installing solar to produce their own energy instead of buying it from the utilities.

Custom Search Back from this page on SRECs to our Home Page for Solar Energy

|