|

Solar Stocks Increase After Sendai Earthquake but are Sill Undervalued

Solar stocks have seen some nice gains in reaction to the concerns about the long-term impact on the nuclear power industry following the Sendai earthquake and subsequent tsunami. Shares of American and Chinese solar companies, such as First Solar, SunPower, Suntech Power and JA Solar, rose around 7-11 percent Tuesday. The climb was a sharp contrast to many other stocks in the U.S. market that fell as worries deepened among investors that Japan may not be able to prevent a nuclear power reactor meltdown. Adam Bergman, director of cleantech investment banking at Deutsche Bank Securities, tells Solar Industry that German solar stocks have fared particularly well in the wake of the disaster.

Part of the reason these solar stocks are increasing is of course related to the well-publicized problems of the Fukushima Dai-Ichi nuclear plant in Japan. Before the 9.0 earthquake hit Japan on March 11th, nuclear power was gaining support in the United States as a good alternative to power from coal. President Obama mentioned nuclear power in his State of the Union address in January this year, and both Republican and Democratic lawmakers have shown their support in varying degrees. What’s happening in Japan will certainly intensify debates over the safety of nuclear power. And that makes solar seem a safer bet. Others still remember the BP oil spill – and if they forgot, they've seen oil and gas prices increase as a result of ongoing political changes in the fossil fuel rich Middle East and Northern Africa. And even while Bill Gates and Warren Buffet are rumored to be investing in clean coal – China is announcing a major shift to renewable energy with a big focus on solar in its latest 5-year master plan, and have provided more than $34 Billion in financing to leading Chinese solar companies pushing their solar stocks higher. So while other sources of energy are seeing frequent and well-publicized problems - renewable energy technologies, and especially solar energy continues to produce positive press – rapid and sustained growth, reducing costs, increased efficiencies, new technological developments. The result – more and more people are starting to believe in solar, and backing up that belief by investing their money in solar stocks.

But how the quake and tsunami change the dynamics of the solar market in the next 12 months is difficult to gauge, particularly in the early days of the crisis. We are seeing different takes on the longer term impact from market analysts and companies. Market research firm, DisplaySearch, noted that most of the factories for silicon, wafers and solar cells are located around central and southern Japan, not in the northern region that was directly hit by the quake and tsunami. Some equity analysts, such as Barclays Capital’s Vishal Shah, say lawmakers might pass policies more favorable for solar now that nuclear power seems a more risky bet. Others, including Axiom Capital’s Gordon Johnson, don’t see that direct impact. In a research note, Piper Jaffray’s Ahmar Zaman writes that demand for solar energy in Japan, among the top 5 markets in the world, will fall this year as the country focuses its resources on reconstruction and other recovery measures. As a result, Japanese solar companies will try to sell products it originally pegged for the domestic market in other parts of the world and push down the average selling prices of solar panels. Solar companies with factories in Japan are mostly reporting minimal damage to their equipment and buildings, though some may have suspended their production because of a lack of water and electricity. Taiwan-based AUO Optronics did just that at M. Setek, which produces silicon and turn silicon into wafers in northern Japan. Solar Frontier, which recently opened its 900-megawatt factory to produce copper-indium-gallium-selenide thin films, said its factories are located far enough that they weren’t affected by the quake and tsunami. Sharp said its factories didn’t sustain major damage, but the full impact on its operations remains to be seen. While factory equipment is in good shape, the transportation system for shipping materials and products may not be. That is likely to cause a bigger headache for manufacturers, said HIS iSuppli. Solar Frontier certainly pointed to this potential problem in its announcement: “Our supply chain appears to be intact at this time, but we are but we are reviewing all incoming and outgoing logistics as ports around Japan are recovering from the events of Friday.” SunPower, which buys silicon from Japanese companies, said it won’t change the anticipated production volumes for 2011. SunPower said Japanese suppliers provide less than 10 percent of what it needs for the second quarter, and it will be able to find alternative sources if its Japanese suppliers aren’t able to deliver.

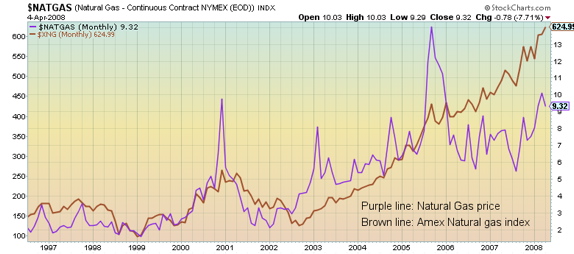

Big solar companies like First Solar and Trina Solar had monster years last year with YTD growth of 4,000% and 2,000% respectively – and are still performing ahead of the stock market this year. Already some solar stocks are off to a great start in 2011. Firms such as Jinko Solar (up 266% in mid March 2011, ReneSola up 260% and Emcore Solar (up 106% YTD) have all racked up impressive gains. Even large volume and well-funded Chinese producers such as Yingli Solar and SunPower are performing better than the overall stock market. But even with recent gains solar stocks are still selling at price-earnings multiples below that of other big energy companies such as oil and gas companies.. One reason makes sense – we don't really know who the long-term winners will be in the solar industry – especially with all the new technological developments coming along and the ever changing incentive structures that vary widely. That may be why the Wall Street Journal still expects natural gas, despite its environmental problems, to outpace solar. I'd like to place a bet on that one. The Solar industry is one of the fastest growing industries in the world and as costs continue to fall for solar and costs for fossil fuels (such as natural gas as you can see from the accompanying chart) and Nuclear energy continue to increase – its pretty clear to me where I think the growth is likely to occur.

The most important fact to keep in mind when investing in solar stocks is that the cost of solar energy keeps decreasing year to year. Substantial reductions took place last year as silicon costs came down significantly from their highs in 2009. Additionally, as production levels were ramped up leading producers saw manufacturing and kWp efficiencies increase which has led to a lower cost per kWp. The same is true also for the other major cost components including: inverter efficiencies increased driving kWp unit costs down; permitting costs are going down as more and more solar installations are undertaken and the permitting process gets streamlined; framing and installation costs are going down as well. Natural gas can never work that way. Greater production, at enormous long-term costs to our water table, could increase supply and maintain costs at near their current level, in the near term. But every cubic meter of gas consumed is one less cubic meter of gas in the ground. Additionally, oil and gas costs fluctuate with political events as the past few years have clearly demonstrated. Meanwhile, the Sun keeps shining. Civilization is never going forward so long as we're tied to the technology of our caveman ancestors, looking around for stuff to burn, then burning it. It progresses – I would argue it starts – when we settle down to harvesting the energy that's all around us. Industry analysts anticipate that the solar market will reach grid parity as early as in 2012, as prominent solar manufacturers near cost parity. Technological advances in manufacturing, economies of scale and increased efficiency of photovoltaic products continue to drive decreasing costs and prices within the solar industry. Grid parity, the point at which alternative renewable electricity is at least as cheap as grid power, is already a reality in some US states and is nearing a tipping point elsewhere in the world, according to analysts’ projections. Thin-film solar module manufacturer First Solar is close to achieving grid parity as the result of its Boulder City project that was developed for Sempra Generation, said analysts World Street Fundamentals (WSF). The manufacturer has reduced costs to below $0.10 per kWh, according to the analysts’ estimates. Market demand for solar energy has experienced steady growth over the past 20 years, averaging 30 per cent growth year-on-year. The anticipated introduction of grid parity pricing is expected to further increase demand moving towards the 2020 emissions target date and beyond. Accelerated exponential growth in the industry and continue increases in solar stocks is a very real possibility, said WSF, as consumers increasingly opt for renewable energy alternatives to fossil fuels.

As is always the case – not all solar stocks have increased since the beginning of the year and some well publicized companies such as Evergreen (down 59%) as well as other firms such as Real Goods Solar (down 76%), and Energy Conv. (down 55%) remind us that you need to choose carefully as not every solar stock will increase. While some analysts are still confident that 2011 will see continued growth in new solar installations – the rate at which new production capacity is being added into the marketplace has led some to believe that an oversupply situation could develop that would depress margins. The situation in Japan could have an impact on this as well as the PV industry is assessing possible solar supply-chain risks stemming from disaster damage and production stoppages at Japanese factories that provide PV materials, especially solar silicon. Among Japan's three largest polysilicon producers - Tokuyama, Mitsubishi and M. Setek - only M. Setek, owned by AUO, has sustained major disaster damage, according to Annis' post. The company has suspended production at its factory, which is located in hard-hit Soma Fukushima. Annis points out that the "entire Japanese economy will be limping along for a while, which may cause some minor shipment and short-term pricing issues for PV components." Global supply-chain impact, however, is expected to be limited, as Japan accounts for less than 10% of total polysilicon, wafer and cell production capacity. San Jose, Calif.-based module manufacturer SunPower echoed this assessment in a recent announcement, noting that less than 10% of its polysilicon is sourced from Japanese suppliers. The company added that although some of its supply-chain partners are experiencing production disruptions, none has sustained major facility damage, and alternate sources of polysilicon are available to replace any lost supply. Overall, Japan-based firms such as Kyocera, Sanyo and Mitsubishi dominate the country's PV market, and foreign companies have little economic exposure, according to Jefferies' research note. "Japanese solar companies' market share outside of Japan is greater than Western/Chinese companies' market share in Japan," the note explains. "Thus, we believe Western/Chinese solar companies such as Yingli can grow share at the expense of Japanese players affected by the disaster."

Whether you are looking for more in-depth analysis about solar stocks, specific companies, solar industry news, latest industry research reports, technological developments or related subjects - use our built-in / Google Powered site searching tool below. Just type in a few key words or phrases to search this site and our blogs – with more than 550 articles published to date about solar energy.  Custom Search

|